FxPro Review

FxPro Review

Founded in 2006 with its headquarters in London, FxPro has grown to become one of the world’s leading forex trading brokers.

With regulation in several jurisdictions, including the UK, Cyprus, Bahamas, and South Africa, FxPro has a reputation for being transparent and reliable.

Moreover, FxPro offers access to tight spreads, favorable commission rates, and multiple powerful trading platforms, making this forex trading platform an ideal option for the novice or experienced trader.

Regulation

FxPro is regulated in several jurisdictions, including:

- FxPro UK Limited is authorized and regulated by the Financial Conduct Authority (FCA).

- FxPro Financial Services Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC)

- FxPro Financial Services Limited is authorized and regulated by the South Africa Financial Sector Conduct Authority (FSCA)

- FxPro Global Markets Limited is authorized and regulated by the Securities Commission of The Bahamas (SCB)

These regulations ensure that clients at FxPro feel a strong sense of security as these authorities have a strong reputation for maintaining a fair and safe market for investors.

Regions Available

FxPro is an available broker in the Forest Park FX cash back rebate program to traders in Latin America, Europe, Middle East, and APAC regions, subject to certain country-specific restrictions. Due to regulations it is not currently available to United States or Canadian residents.

“Trading CFDs involves significant risks”

Minimum Deposit

According to the FxPro help section, the recommended initial deposit $500. However, clients may deposit as little as $100 each time. This makes the forex trading platform especially ideal for new forex traders.

This minimum deposit is fairly low when compared to other major brokers, which increases accessibility to a robust forex trading platform to low-volume traders who do not wish to deal with large amounts of capital at a time.

Types of Accounts

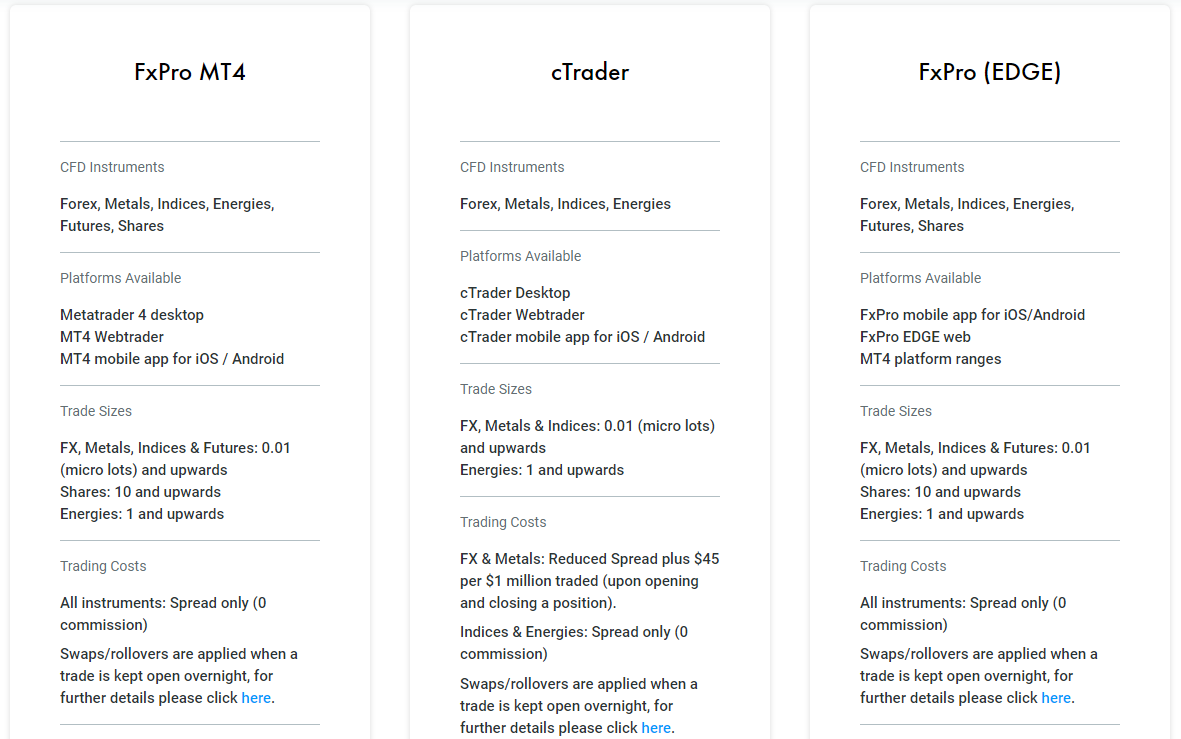

Clients can choose between several different types of accounts with FxPro depending on the platform they choose to use and their trading volume.

FxPro MT4

With an FxPro MT4 account, clients can take advantage of a free demo account, fixed spread and variable pricing, and competitive spreads.

This account uses MetaTrader 4 as its trading platform. For this reason, this account will likely be ideal for many traders who are used to this industry-leading platform.

MT4 users can choose between market execution and instant execution, with the latter allowing users to receive never have a requote. Market execution offers tiered liquidity, and orders are executed at the volume-weighted average price. The average spread for instant execution on EUR/USD is 1.71 pips and 1.58 pips for market execution.

When trading forex and metals, FxPro uses a spreads-only pricing model rather than a commission plus spreads model. There is also no commission when trading futures, shares, indices, or cryptocurrencies.

FxPro MT5

Like the MT4 accounts, the MT5 accounts offer demo accounts, micro accounts, and competitive pricing.

FxPro MT5 accounts offer market execution with average EUR/USD spreads of 1.51 pips. The pricing model for MT5 accounts is the same as it is for MT4 accounts — spread markups with no commission.

Besides offering users a more modern MetaTrader platform and the differences listed above, MT5 accounts offer the same features as MT4 accounts.

FxPro cTrader

Users who opt to use cTrader will still have access to demo accounts, micro accounts, algorithmic trading, and mobile trading.

Other than the use of a different platform, the main difference between cTrader accounts and the MetaTrader accounts is the pricing. FxPro cTrader accounts charge a commission of $45 per $1 million traded, and, in exchange, offer clients much tighter spreads with an average spread on EUR/USD of 0.37 pips.

FxPro (Edge)

FxPro (Edge) Accounts are offered on FxPro’s proprietary trading platform.

This account types comes with $0 in commission and competitive swap rates if positions are held overnight. The execution model is market execution: tiered liquidity. Orders are executed using VWAP or volume weighted average price, so if an order is not able to be filled at the top of book pricing, it is filled at multiple levels and the price returned is averaged.

Like their other accounts, the stop out levels are 50% for FxPro CY and FxPro UK clients, and 20% for FxPro GM clients.

Deposits & Withdrawals

For deposits and withdrawals, FxPro uses its FxPro Wallet, which allows clients to transfer money between their trading accounts and FxPro wallet. This allows their funds to be available for trading without being affected by unexpected market movements.

FxPro UK clients can make deposits via Visa, Maestro, Mastercards, and American Express bank transfers, and broker to broker transfers. FxPro does not charge any fees on deposits or withdrawals with these methods.

Funding via credit/debit cards takes as little as 10 minutes. Bank and broker to broker transfer deposit times vary while withdrawals generally take one business day.

Commissions & Fees

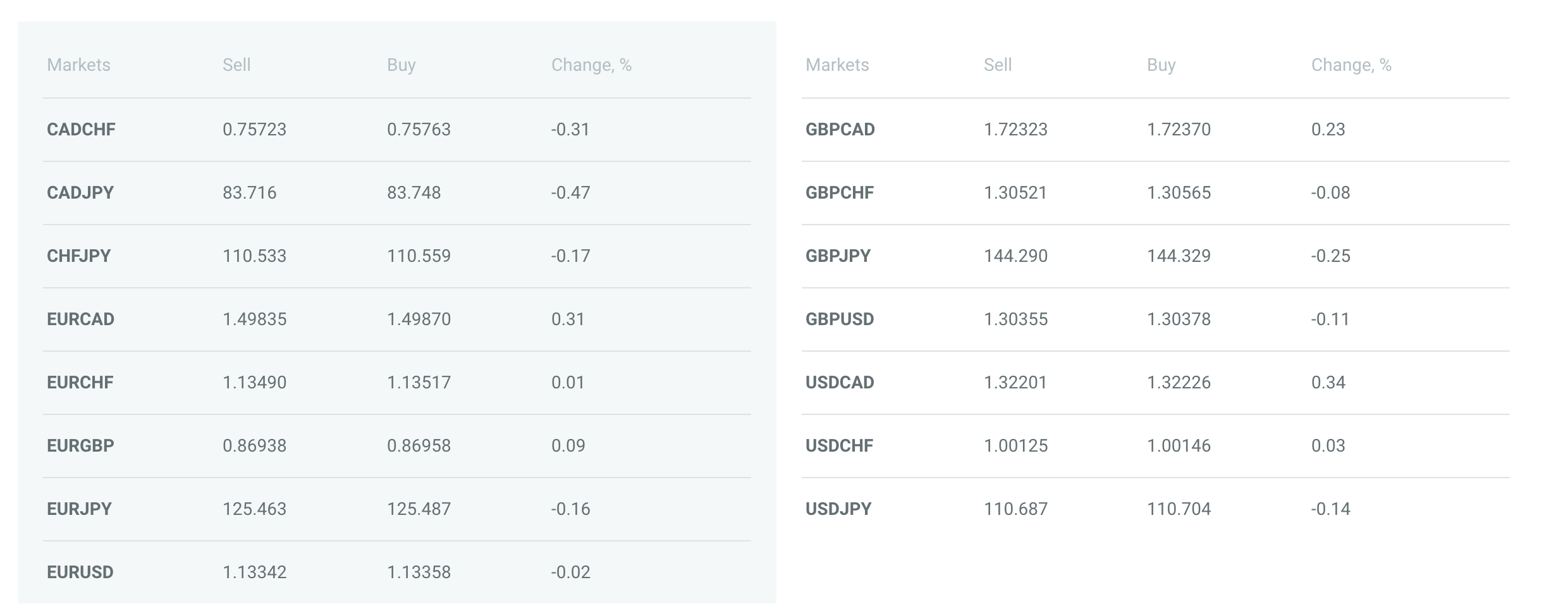

Commissions and spreads depend on both the platform and execution method that you choose to use.

MT4 account holders can expect average spreads on EUR/USD from 1.71 pips when using instant execution and 1.58 pips when using market execution — both of which are very competitive with spreads offered by other major brokers.

MT5 account holders enjoy the ability to utilize market execution and can expect spreads on EUR/USD from 1.51 pips.

FxPro cTrader clients can expect spreads from as low as 0.37 pips on EUR/USD and must pay a commission of $45 per $1 million traded, which is fairly low when compared to commission rates charged by other major forex brokers that offer similarly low spreads.

“Trading CFDs involves significant risks”

Trading Platforms & Tools

FxPro offers its clients access to several powerful and innovative trading platforms.

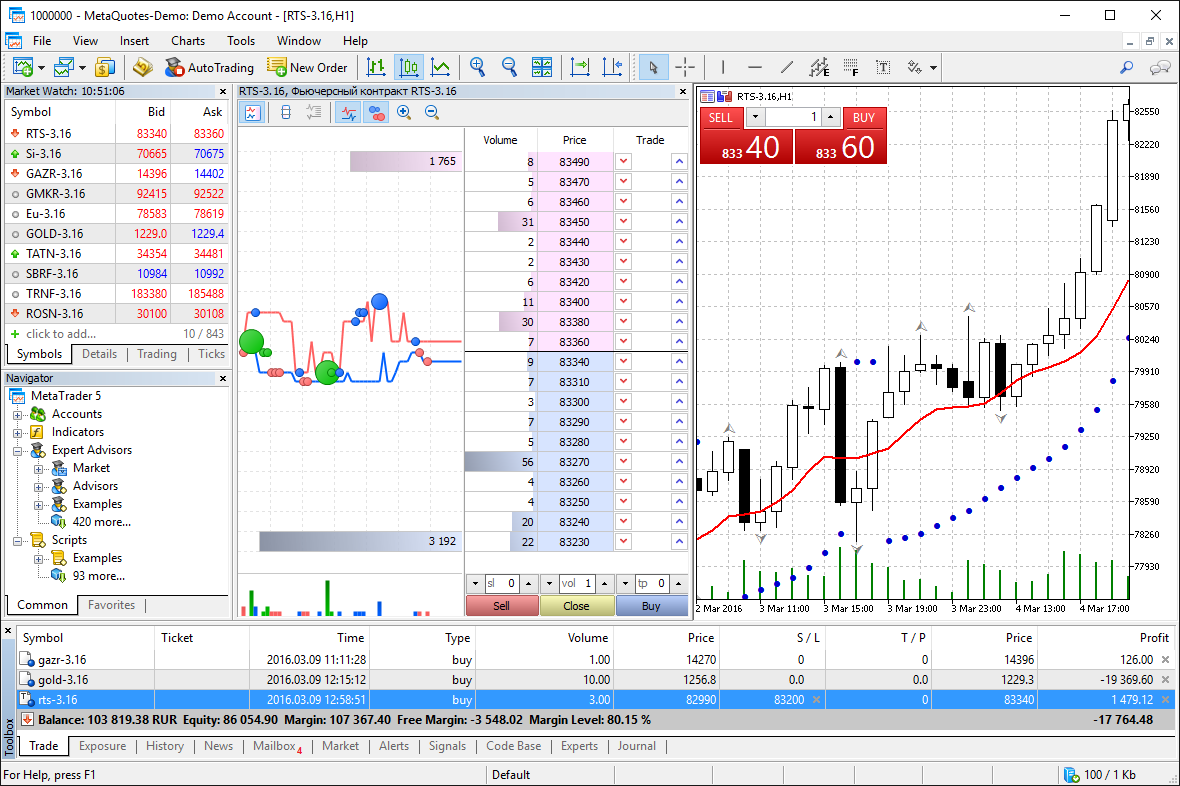

MetaTrader 4

MetaTrader 4 remains the most commonly used trading platform in the forex industry due to its incredible charting capabilities.

MT4 offers its users:

- One-click trading directly from charts

- 50+ preinstalled technical indicators

- 3 chart types and 9 timeframes

- Trailing Stops

- Fully customizable charts

Other notable features include trade copying, which allows users to subscribe to signals from experienced traders and copy their trading strategies. MT4 also supports automated trading via Expert Advisors. Users can develop and test their automated systems before implementing them in MT4’s optimized development environment.

MT4 also offers access to real-time market news, analysis, and price alerts.

MetaTrader 4 is available on all major browsers and operating systems.

MetaTrader 5

MetaTrader 5 provides access to the features that MT4 users expect in addition to a number of other beneficial resources.

As opposed to the nine time frames available on MT4, MT5 users can chart assets on 21 different time frames and have up to 100 charts open at any time. MT5 also supports 4 execution modes, unlimited trading accounts, built-in order routing, tick chart trading, and more.

Overall, MetaTrader 5 is a fantastic platform that takes the powerful capabilities of MT4 and builds on them.

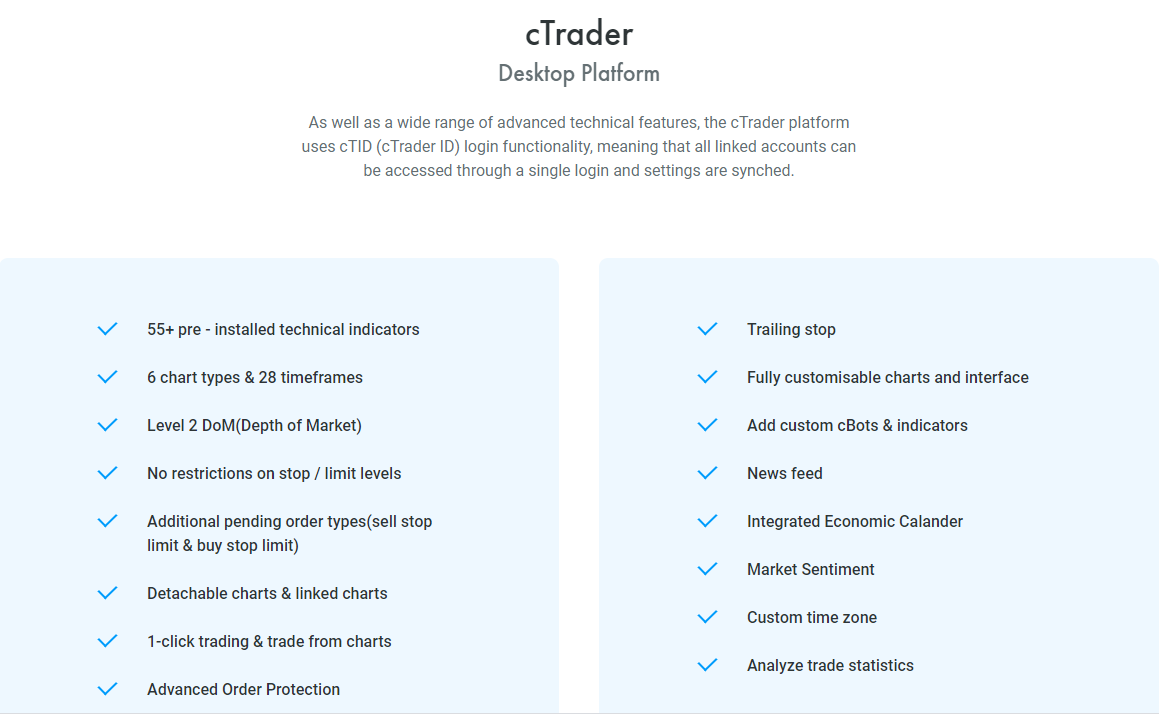

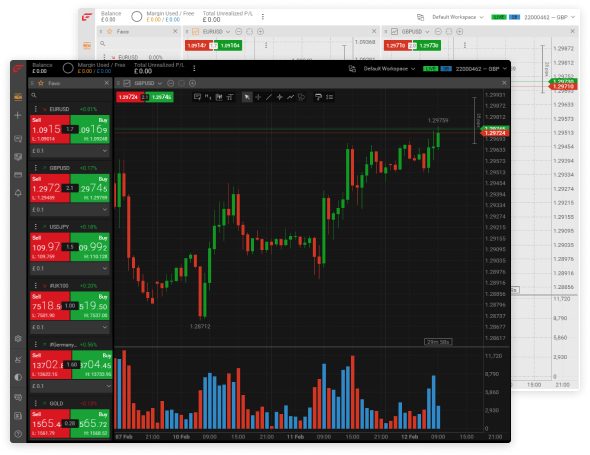

cTrader

While cTrader is a much newer platform than Metatrader 4 or 5, it has become very popular due to its charting and analytical capabilities.

cTrader executes orders in just milliseconds, offers spreads from 0.37 pips, full market execution, no stop/limit level restrictions, and full market depth.

Moreover, cTrader offers a very user-friendly interface, supports algorithmic trading via its proprietary cBots feature, and provides access to real-time forex and CFD quotes.

Overall, cTrader is an incredibly powerful tool that offers a plethora of resources from real-time news updates to the ability to implement automated trading strategies.

FxPro (EDGE)

This proprietary trading platform offered by FxPro is geared toward the point and click trader. It comes standard with multiple chart type options including: Line, Bar, Candle Sticks, Heiken Ashi, HLC, and Dots.

Further more, there are 15 chart timeframes, 50+ preloaded indicators, and trading from the charts is a main focal point.

Mobile Trading

MetaTrader 4, MetaTrader 5, and cTrader all offer optimized mobile apps that retain nearly all of the features as their web-based and desktop versions.

Android and iOS users have the ability to take advantage of real-time news updates and price alerts. They can even trade directly from charts.

Each app has numerous built-in indicators and drawing tools in addition to several order types and lightning-fast execution.

Whether you opt to use MT4, MT5, or cTrader, you can be sure that the mobile version of your chosen platform will allow you to keep up with the market from any location.

Additional Resources

FxPro offers its clients several other resources to help them develop their trading strategies.

FxPro Tools

FxPro Tools is an app that provides users with real-time market information on instruments like forex, shares, futures, indices, metals, and energies.

The FxPro Tools app, which is available on mobile devices and as a browser extension, includes a trader’s dashboard, an economic calendar, trading calculators, access to FxPro’s blog, and market monitoring.

FxPro Tools is a fantastic resource which gives clients easy access to news updates, analysis tools, and more.

Customer Service

FxPro provides excellent customer support 24 hours per day, 5 days per week.

Customer service can be contacted via live chat, email, phone, or at FxPro’s offices in London, Cyprus, Monaco, and Nassau.

Customer support is provided in several major languages, including English, French, and German.

Final Thoughts

FxPro remains one of the top forex trading brokers in the world for a variety of reasons.

Competitive spreads, commission rates, and execution speeds make FxPro an attractive option for forex traders looking for a cost-effective trading broker.

Moreover, access to multiple platforms, including the industry-leading MT4 and MT5 platforms, gives clients several options. This helps ensure that whatever your needs are, they will be fulfilled by one of these trading platforms.

Other features like FxPro Tools, and FxPro Edge provide customers with additional resources. These features along with strong regulation and exceptional customer service make FxPro a premier forex broker.