Equiti Review

Equiti Review

Equiti Group Ltd oversees several leading FX and CFD brands throughout the world. This includes offices in the Middle East, Europe, Asia, Latin America and Africa. With regulation in several jurisdictions, including United Kingdom, Armenia, Jordan and Kenya,

Equiti is a leading forex trading broker in terms of transparency and trustworthiness.

Equiti offers its clients access to industry-leading tools and resources to help them achieve success in their trading endeavors. Offering competitive spreads on its 60+ currency pairs and favorable commission rates for Premiere Account holders, Equiti is an attractive option for investors of any experience level.

Regulation

Equiti Group Ltd is the parent company of multiple premier FX and CFD brokers throughout the world. The companies under Equiti Group Ltd are regulated by some of the most reliable and trustworthy regulatory bodies across the globe.

The FCA regulates Equiti Capital UK limited, with their London registered offices. Additionally, Equiti Group Limited Jordan is authorized and regulated by the Jordan Securities Commission (JSC). They also maintain regulations with Divisa Armenia, and as of mid-2018, became the only non-dealing Forex broker in Kenya.

These regulatory bodies serve as financial and administrative authorities that develop, regulate, and monitor the capital market in their jurisdictions with the intent to protect investors. The organizations are trusted to comply with international standards and ensure a safe and fair market for domestic and foreign investors.

REGIONS AVAILABLE

Equiti is an available broker in the Forest Park FX cash back rebate program to traders in the Middle East and APAC regions, subject to certain country-specific restrictions. At this time it not not currently available to United States, Canada, Latin America, or European regions.

Minimum Deposit

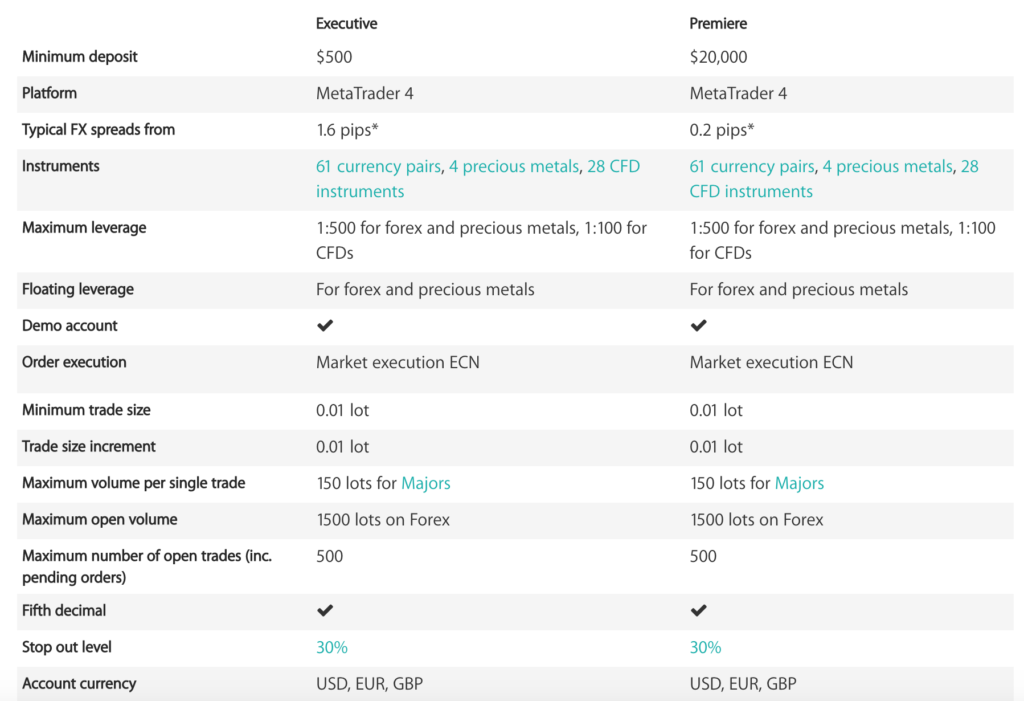

The required minimum deposit depends on the account that you open.

To open an Executive account, Equiti requires clients to make a minimum deposit of at least $500. This is a fairly low deposit that should make opening an account at Equiti accessible for low-volume and novice traders.

For Premiere accounts, Equiti requires a minimum deposit of at least $20,000. This, of course, is geared more towards experienced and high-volume traders.

Types of Accounts

As discussed above, individuals can choose between two types of accounts at Equiti: Executive and Premiere.

Executive Account

Equiti’s Executive Account provides clients with access to powerful tools and resources, such as the incredibly popular MetaTrader 4.

Executive Account holders can take advantage of market order execution and automate their trading using Expert Advisors. Customers can trade over 60 Forex pairs, precious metals including Gold and Silver, and 15 Commodities and Indices CFDs.

Clients also have access to Equiti’s Non-Dealing Desk (NDD) and ECN technology. This technology provides account holders with tighter spreads and faster execution speeds by integrating with several top liquidity providers.

Executive Accounts support USD, EUR, and GBP, allow for micro trading, do not require a commission, and offer typical FX spreads from 1.6 pips.

Premiere Account

Premiere Accounts at Equiti are designed for professional-level traders who have more particular needs than the average client.

Like Executive Account holders, clients with a Premiere Account can trade over 60 currency pairs, precious metals, and CFDs. Premiere Account holders also have access to automated trading, risk management functionality, and NDD execution.

Customers with Premiere Accounts are offered access to deep liquidity and institutional-level pricing from multiple Tier 1 liquidity providers. Equiti also offers a variety of free research tools to aid in performing technical analysis.

The primary difference between Premiere and Executive accounts is the pricing. Executive accounts pay a competitive commission in order to experience much tighter spreads. Premiere Account holders pay a commission of $7 per round turn lot. Typical spreads for Premiere Accounts start as low as 0.2 pips.

Like most other brokers, Equiti allows potential clients to open a demo account to practice trading in a simulated environment before they are ready to begin live trading.

Deposits & Withdrawals

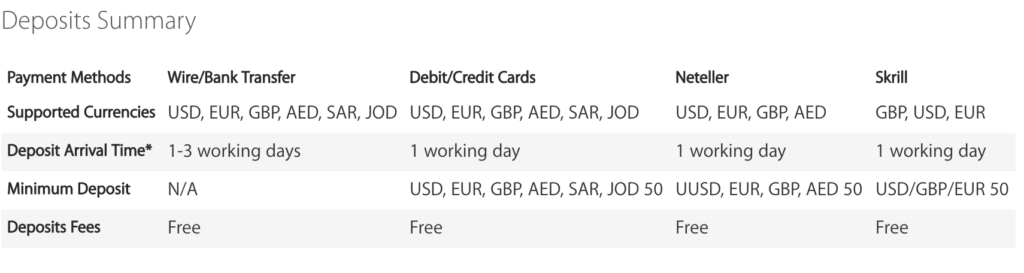

Making deposits and withdrawals with Equiti is a seamless and easy process. Deposits can be made via various methods, including:

- Debit/Credit Cards

- Bank Transfer

- Neteller

- Skrill

For all payment methods, with the exception of bank transfer, deposits take only one day to process. For bank transfers, it takes one to three days to process. Equiti does not charge any deposit fees.

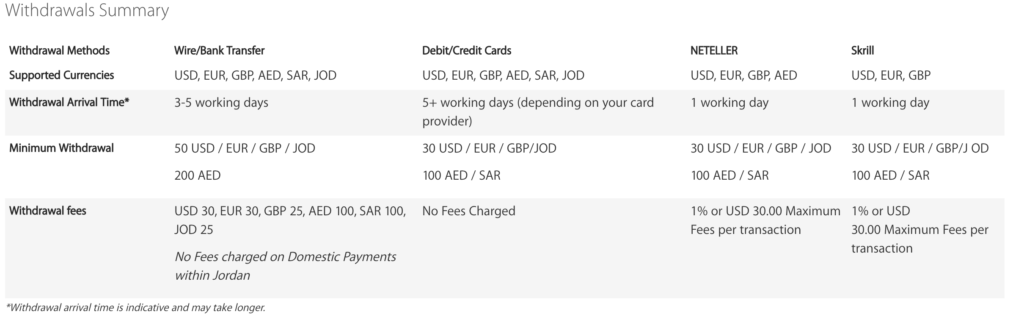

Withdrawals can be made via the same methods listed above for deposits. For Neteller and Skrill, withdrawals take one working day to process whereas bank transfers take three to five working days and debit/credit cards take five or more working days.

The minimum withdrawal for bank transfers is $50 and $30 for every other method.

Equiti charges a $30 withdrawal fee for bank transfers, 1% or $30 for Neteller and Skrill, and no fees for debit/credit card withdrawals. These withdrawal fees are considered standard and comparable to many other major brokers.

Trading Platforms & Tools

Equiti uses the incredibly powerful MetaTrader 4 as its sole trading platform and offers several other research and educational resources to its clients.

MetaTrader 4

MetaTrader 4 (MT4) is an industry-leading trading platform that has powerful charting and research capabilities. MT4 can be used on any browser and operating system.

MetaTrader 4 allows users to implement the most complex trading strategies by offering 3 execution modes, two market orders, four pending orders, and two stop orders, and a trailing stop.

MT4 also offers amazing analytical capabilities, including interactive charts with nine time periods and online quotes. Moreover, traders have access to 23 analytical objects and 30 built-in technical indicators. Additionally, the free Code Base and online market offer thousands more indicators — further increasing MT4’s analytical functions.

This platform also has built-in copy trading. This means that you can choose a more experienced trader to follow, subscribe to their signal, and let your system copy their trades automatically. Users can choose from thousands of free and paid trading strategies to follow.

MetaTrader 4 also provides a great environment to develop, test, and optimize algorithmic trading strategies. This allows traders to implement just about any strategy as an Expert Advisor.

Lastly, users have access to real-time financial news updates to help them stay on top of important updates and adjust their strategies accordingly. Traders can opt to receive customized alerts when certain events occur such as price changes.

Overall, MetaTrader 4 is essentially the ultimate trading platforms — allowing traders of any experience level to take advantage of its many features and capabilities.

Mobile Trading

Equiti also offers mobile trading through the MetaTrader 4 mobile app on iOS and Android devices — allowing traders to manage their positions and stay current with market news from any location. The MT4 mobile apps retain most of the functionality provided by the desktop and web-based versions.

Users can access many of the features that they are used to, including:

- All order types

- Symbol charts

- 30 technical indicators

- 23 analytical objects

- Financial market newsTrade history

Interactive charts on mobile show real-time currency rate changes and users can make trades directly from these charts.

All things considered, MetaTrader 4 on mobile devices has almost identical functionality and capabilities when compared to its browser-based and desktop counterparts.

Academy

Equiti’s Academy is essentially an education center that offers a variety of tools, resources, and guides to help beginner, intermediate, and advanced traders develop their strategies and expand their knowledge.

A vast collection of infographics can be used as references by customers to help understand the fundamentals of forex trading and using the MetaTrader 4 platform.

Equiti is also working to develop a collection of in-person seminars. These seminars will be lead by experts from the Equiti Group to help traders expand their knowledge on a wide range of topics relevant to forex trading.

The Academy also offers a collection of webinars for beginners, experts, and intermediate traders. These are meant to teach everything from the basics of forex trading to understanding complex chart patterns.

Equiti offers a number of written guides on basic topics such as “What is Forex?,” “Why Trade Forex,” and “Trading on Leverage and Margin.”

Lastly, Equiti clients can access a library of videos which offer detailed visual lessons on important topics such as “What is a PIP and a Spread?”

Equiti’s extensive library of educational resources demonstrates its dedication to helping its clients succeed.

Research Tools

Equiti also provides customers with access to the research tools that you would expect to be available from a worthy forex trading broker.

The economic calendar allows users to view and filter major announcements relating to the market. Equiti’s real-time economic calendar is automatically updated to cover events and indicators from across the globe.

Equiti’s trading calculators cover margin, pip value, profit/loss, and risk percentage effectively and efficiently. These calculators can also be used to manage your risk and calculate trades.

Customer Service

Equiti customer support is available 24 hours per day, 5 days per week. Clients can contact support by submitting a message directly on Equiti’s website, by calling them, by email, or via live chat for more time-sensitive inquiries. The company can also be contacted through its social media profiles on Facebook, Twitter, LinkedIn, and Google+.

Final Thoughts

All things considered, Equiti is a fantastic forex broker that accommodates novice, experienced, low-volume, and high-volume traders.

Executive Accounts offer competitive spreads and accessibility for discretionary traders while Premiere Accounts allow high-volume traders to take advantage of tighter spreads and favorable commission rates.

Additionally, innovative and powerful trading tools and platforms, strict regulation, low fees, and dedication to customer support via educational resources make Equiti an ideal forex trading broker.